A very common practice among small business owners is to combine several responsibilities or functions into a single role. We see this most frequently in administrative roles. For example, an Office Manager may be assigned duties that combine that of a Receptionist, Bookkeeper, HR Generalist and Customer Service Specialist. It’s understandable why employers might create such a role; they need all of the responsibilities for these functions done, yet separately, they don’t justify having a full or part-time employee for each. The business owner is focused on growing their respective company and doesn’t want to get bogged down shouldering this administrative burden on their own.

Perhaps most commonly, we see the roles of Accounting and HR combined into one position. For the same reasons above, the owner seeks efficiency and cost savings in creating such a role. This is typical for Bookkeeping/Accounting type roles that also include administrative HR functions such as Payroll and administration of Employee Benefits, Workers’ Compensation and 401K plans. Simply take a look at any recent job posting for a Full-Charge Bookkeeper and you’ll likely see these duties included in the job description.

But operating like this can present some challenges and add a significant amount of risk to the business. These can include:

Lack of specialization

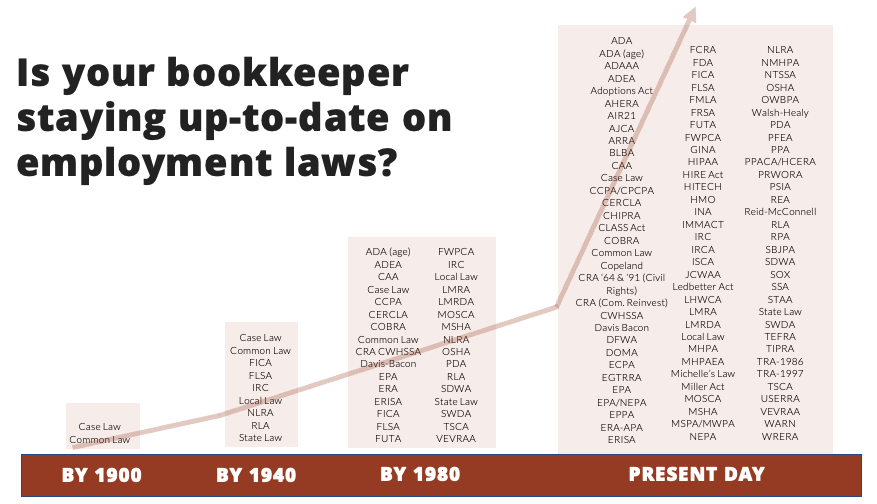

While there may be some apparent synergies in combining accounting and HR-related functions like payroll, the field of Human Resources is a special discipline of its own, requiring training and experience in dealing with areas such as ever-changing employment laws (local, state and federal), changing regulations for employee benefits, payroll taxes and other compliance-related issues.

If an individual lacks sufficient training, expertise or certification in either field, it can result in errors, misinterpretation of laws, non-compliance and missed opportunities.

Conflict of interest

Accounting and HR have different roles and responsibilities in a business with different objectives – and when combined, can create a conflict of interest. For example, someone in a pure HR role would likely advocate for employee benefits or other investments in training, leadership development, etc., while accounting wants to control costs. We’ve seen this conflict arise often in small companies, as individuals in an accounting/HR “combo” role feel conflicted in trying to satisfy the needs of the employees vs. the needs of the owner. These conflicting priorities can create tension and compromise the quality of decision-making.

Increased workload

One natural consequence of combining accounting and HR in the same role is the obvious increase in workload, which can then lead to quicker burnout, higher stress, decreased productivity and greater turnover in the position. Add to this the difficulty of trying to balance the demands of both roles in peak periods like tax season and benefits open enrollment.

Opportunity cost

Employees in these accounting/HR roles often feel conflicted trying to prioritize their responsibilities. For example, if the employee is an accountant by background, but is given HR responsibilities as part of the role, they often have to make trade-offs on which tasks get done in what priority. Tasks that are usually more urgent give way to tasks that are important such as budgeting, financial forecasting, margin analysis, job costing, and other financial analysis. These more important, but not urgent tasks that could be enormously beneficial for the business get put on the back burner, because payroll has to be run or a workers’ comp audit must be completed. Now consider the opportunity costs – what kinds of powerful insights could any of the financial analyses above provide to the company that could increase gross profit margins, reduce operating costs, improve cash flow and increase overall profitability?

Passion and interest

This is a natural area to overlook when combining Accounting & HR. An individual with a strong HR background or Accounting background may not be very excited or energized at doing the other. What’s the cost? When employees don’t have a strong desire or passion for the work they do, productivity suffers and errors and delays are more likely to occur.

Security and confidentiality

If there are any two functions that deal with a high degree of sensitive and confidential information, it’s accounting and HR. Combining these roles can increase the risk of data breaches, errors, omissions, etc., which ultimately can result in significant financial and legal consequences.

Consider the amount of financial influence someone has who has ownership of both the finances and payroll for the business! We know a number of instances with clients and other small businesses where fraud and embezzlement have occurred under the eyes of a trusting business owner. There are dozens of headlines each month reporting such situations across the country.

In summary

While combining accounting and HR in the same role can (on the surface), appear to make good business sense, it’s vital to carefully weigh the potential risks and challenges in doing such to make sure your business doesn’t create undue risk exposure.

So, if combining these functions creates too much risk for a business owner, what are the alternatives?

A great solution to addressing the challenges and risks above is Outsourcing.

Outsourcing HR and/or Accounting can be an ideal solution for a small business owner. A professional outsourcing partner provides the horsepower of a full HR or Accounting Department, scaled to the needs of the business owner at a fraction of the cost. The owner also gains access to efficiencies and best practices that otherwise may not be realized in a single employee. For example, one of our clients who outsourced both HR & Accounting reduced what had been taking 30 hours a week down to about 8 hours a month. Focus HR partners with a number of exceptional Accounting professionals to handle the various bookkeeping/accounting needs of a business. Please check out a recent case study here.

Of course, each business is unique and has different needs and situations that may require an employer to handle HR and Accounting internally in a specific way, but overall, outsourcing HR and/or Accounting provides a viable alternative solution that every business owner should evaluate.

If you are interested in exploring outsourcing HR for your small business, get in touch for an obligation-free consultation today.