UPDATE NOVEMBER 18, 2024: Please be advised that we have just been informed that on Friday November 15, 2024, the U.S. District Court for the Eastern District of Texas vacated and set aside the U.S. Department of Labor (DOL)’s final regulation increasing the salary threshold for the “white collar” overtime exemption under the Fair Labor Standards Act (FLSA) on a nationwide basis.

The court held that each of the three components of the rule exceeded the DOL’s statutory authority under the FLSA. And given the nationwide scope of the rule, it concluded that the rule is struck down on a nationwide basis.

This means that the increase in the overtime threshold scheduled to become effective on January 1, 2025, will not go into effect. The court also struck down the July 1, 2024, increase that previously went into effect, although this may have limited practical effect for many employers that may have already adjusted their payroll to comply with that increase. With the decision, the salary threshold set in the 2019 regulations ($35,568 per year or $683 per week) will be the salary threshold employers should adhere to.

Employers that previously adjusted the salaries or exemption status of employees who earned less than the salary threshold set by the now-invalidated July 1 increase are advised to consult with counsel before considering whether to rescind those changes on a going-forward basis. If employees were moved to an hourly basis due to the increase in July, please note that if they are performing the same job they were doing in July, they can be moved back to a salary position if preferred. This will need to be done at the beginning of a pay period and the employee notified in advance but does not necessarily have to be done Jan 1.

Employers should also remain aware that some states have salary thresholds that exceed the FLSA threshold, including Alaska, California, Colorado, Maine, New York, and Washington. If you have salaried employees in these states, please contact us for current minimums for 2025.

Ever feel like changing regulations just love coming at your business like curveballs? It’s hard enough to focus on all the other plates you need to keep spinning as an employer, then “BAM!,” yet another regulation change comes your way! But never fear, Focus HR’s got your back.

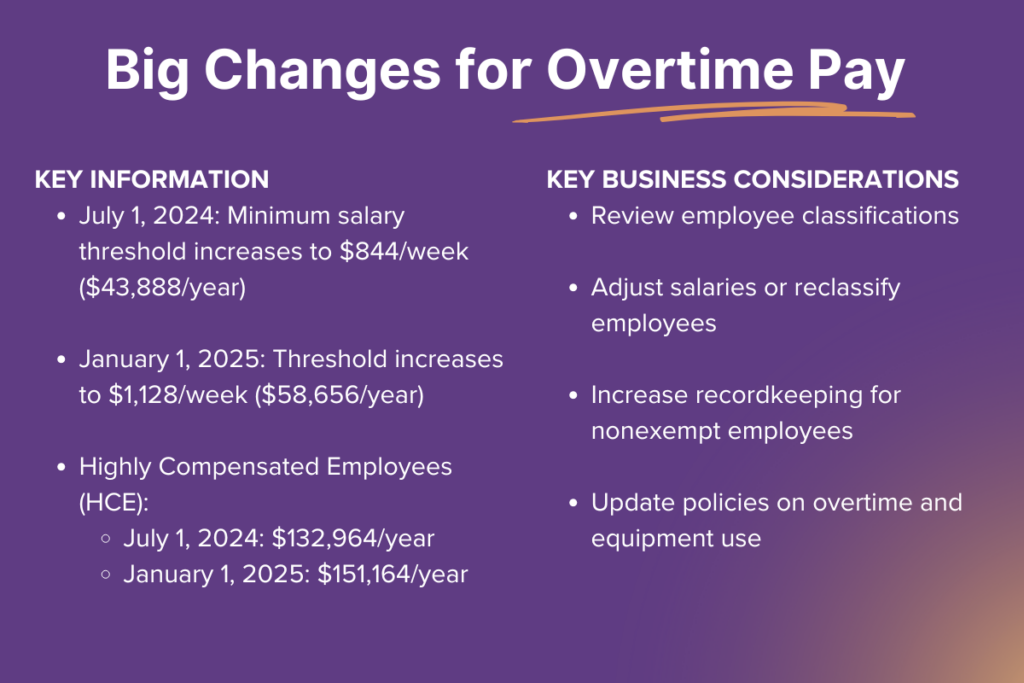

A forthcoming change regarding salaried exempt employees is about to change and could have significant implications on your bottom line. The salary threshold for overtime eligibility under the Fair Labor Standards Act (FLSA) is about to increase (and not by a small amount!). This update, effective in two phases, will significantly impact how you classify employees and manage overtime.

Understanding the New Thresholds

- Starting July 1, 2024: The minimum salary for exempt employees increases from $35,568 annually ($684 weekly) to $43,888 annually ($844 weekly).

- Beginning January 1, 2025: The threshold will further rise to $58,656 annually ($1,128 weekly).

These changes mean more employees may qualify for overtime pay unless their duties qualify for an exemption under the FLSA. Please note that employees must meet BOTH criteria to be exempt from overtime: job duties AND salary.

Don’t Forget About Your High Performers!

There’s another key change to be aware of – the update to the salary threshold for highly compensated employees (HCE). Originally, the proposal outlined smaller increases, but the final rule brings them up even further. Here’s the breakdown:

- Effective July 1, 2024: The minimum annual compensation for HCE exemption will jump to $132,964.

- By January 1, 2025: That number climbs again to $151,164.

This means some employees who may have qualified for the HCE exemption previously might not be under the new thresholds. Don’t forget to factor this in when reviewing your employee classifications.

Understanding Overtime: The Basics for Businesses

Before diving into the new overtime rules, let’s establish a solid foundation with a quick explainer on overtime pay and employee classifications.

What is Overtime Pay?

Under the Fair Labor Standards Act (FLSA), overtime pay is the additional compensation an employee earns for working beyond 40 hours in a workweek. This rate is typically one and a half times their regular hourly rate for each overtime hour. However, some states have additional overtime requirements, so it’s important to check your local and state laws.

However, there’s a catch: not everyone qualifies for overtime pay. The FLSA classifies employees as either exempt or nonexempt based on their salary and job duties.

Who Pays Overtime?

Any business covered by the FLSA is required to pay overtime to nonexempt employees. Generally, this applies to businesses with:

- Enterprise Coverage: At least $500,000 in annual sales or engaged in specific industries like healthcare or education (regardless of the number of employees).

- Individual Coverage: Employees performing certain duties across state lines or working for specific domestic service providers.

Even if your business doesn’t meet the criteria for Enterprise Coverage, you might still have obligations under your state’s overtime laws. Additionally, some employees might qualify for Individual Coverage under the FLSA. Consulting with your HR Advisor or an employment attorney is crucial to understand your specific requirements.

Exempt vs. Nonexempt Employees:

- Nonexempt Employees: These employees must be paid minimum wage for all hours worked and overtime for any hours exceeding 40 in a workweek. Some states have stricter regulations, like California requiring overtime pay after eight hours in a workday.

- Exempt Employees: Typically salaried professionals, executives, or administrators who meet specific criteria:

- Salary Threshold: Meets or exceeds the minimum salary level set by the Department of Labor (DOL) – currently $844 weekly (rising to $1,128 in 2025).

- Salary Basis: Receives a fixed salary regardless of hours worked.

- Job Duties: Performs duties categorized as exempt under the FLSA, such as those requiring independent judgment or managing employees. There are additional exemptions for outside sales, learned professionals, computer employees, and highly compensated employees (HCEs).

Can Employers Refuse Overtime Pay?

Absolutely not! FLSA-covered employers are legally obligated to pay overtime to nonexempt employees, even if the overtime wasn’t authorized. You can have a policy against unauthorized overtime and discipline employees who violate it, but any overtime hours worked must be compensated at the appropriate rate. Failing to do so can result in significant penalties, including back pay, fines, and legal fees.

Can Employees Refuse Overtime?

Yes, employees generally have the right to refuse overtime requests. However, in “at-will employment” states, they can also be terminated for doing so. Some states have exceptions, like California’s one-day rest rule.

By understanding these core concepts, you’ll be better equipped to navigate the upcoming changes to overtime regulations and ensure your business stays compliant.

Strategic Decisions Business Leaders Need to Make Now

The new overtime rules require a strategic approach to employee classification. Here’s how to navigate this change effectively:

Beyond Salary Adjustments

Simply increasing salaries to maintain exempt status might not be the most practical solution for every business, especially for small businesses with tight budgets. Remember, salary is just one factor in determining FLSA exemption. An employee’s primary job duties and how their salary is paid (salary basis test) also play a crucial role.

A Multi-Step Process

- Classification Review: Start by meticulously reviewing each employee’s current classification and actual job duties they are performing. This ensures everyone is categorized correctly under the new regulations and helps you to identify any potential misclassifications.

- Impact Assessment: For employees affected by the increased thresholds, consider your next steps. Will you adjust their salaries to meet the new exempt minimums, or will you reclassify them as non-exempt? Remember, any employee can be classified as Non-exempt (hourly), but classification of any employee as Exempt (salary) must meet the Job Duties test noted above.

Weighing the Options

- Salary Increase: Consider the financial implications of raising salaries for impacted employees. If these employees frequently work overtime, salary increases might be more cost-effective in the long run compared to ongoing overtime payments.

- Reclassification to Non-Exempt: Carefully evaluate the potential consequences of reclassifying employees. This could include:

- Increased Overtime Costs: Expect overtime expenses to rise as non-exempt employees become eligible for overtime pay for hours worked over 40 in a week.

- Employee Morale: Reclassification from exempt to non-exempt might be perceived as a demotion, potentially impacting employee morale and satisfaction. Clear communication explaining the reasons and any potential benefits of the change is crucial.

Beyond Salary and Morale

- Recordkeeping: With more non-exempt employees, your recordkeeping responsibilities will likely increase. Consider investing in new timekeeping technology to streamline administrative tasks associated with tracking employee hours. Focus HR can assist, reach out for a free consultation.

- Benefits: Review how benefits tied to compensation might be impacted by reclassification. For example, some benefits may be based on salary thresholds.

- Company Policies: Revisit policies on the use of company equipment and work hours. Ensure clear expectations for both Exempt and Non-exempt employees regarding these aspects, especially when working outside of regular business hours or while traveling.

- Training and Communication: Provide impacted employees with advance notice and proper training on relevant company policies. This should include timekeeping procedures, meal and rest break policies, overtime work approval processes, and any other adjustments they need to be aware of.

Remember to check your state or local jurisdiction’s laws regarding advance notice requirements for wage changes.

The Bottom Line: Be Prepared, Not Reactive

The upcoming overtime rule changes might seem daunting, but with proactive planning, you can navigate them smoothly. By taking the steps outlined above and considering all potential implications, you can make informed decisions that minimize disruption, maintain employee morale, and ensure legal compliance.

However, navigating these changes can be complex, especially for busy business owners. That’s where Focus HR comes in. We offer a comprehensive suite of HR solutions, including user-friendly HR technology that makes implementing changes like these far more palatable. Our HRIS software streamlines tasks like employee classification, payroll processing, and timekeeping, freeing you up to focus on what matters most – running your business.

Don’t wait until the deadlines loom. Schedule a free consultation with a Focus HR expert today! We’ll help you understand the new overtime rules, assess your options, and develop a customized plan to ensure your business stays compliant.